| Preliminary Proxy Statement | ||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| Definitive Proxy Statement | ||

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

| ☒ | No fee required. | |

| ☐ | Fee paid previously with preliminary materials. | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |

PROXY STATEMENT

EXPRO Proxy Statement Notice of Annual General Meeting of Shareholders

May 25, 2022

24, 2023 expro.com NYSE: XPRO

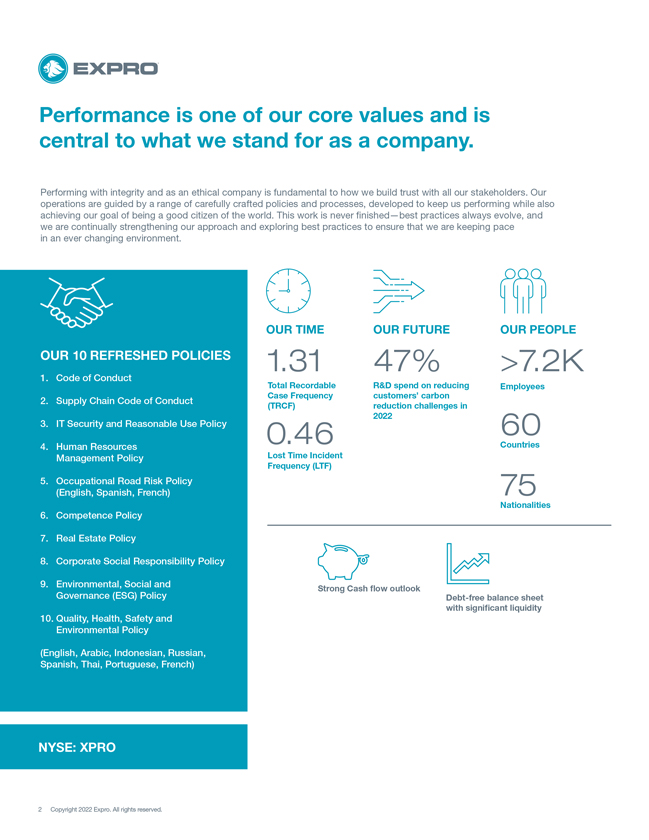

Performance is one of our core values and is central to what we stand for as a company.Performing with integrity and as an ethical company is fundamental to how we build trust with all our stakeholders. Our operations are guided by a range of carefully crafted policies and processes, developed to keep us performing while also achieving our goal of being a good citizen of the world. This work is never finished—best practices always evolve, and we are continually strengthening our approach and exploring best practices to ensure that we are keeping pace in an ever changing environment.OUR 10 REFRESHED POLICIES1. Code of Conduct2. Supply Chain Code of Conduct3. IT Security and Reasonable Use Policy4. Human Resources Management Policy5. Occupational Road Risk Policy (English, Spanish, French)6. Competence Policy7. Real Estate Policy8. Corporate Social Responsibility Policy9. Environmental, Social and Governance (ESG) Policy10. Quality, Health, Safety and Environmental Policy(English, Arabic, Indonesian, Russian, Spanish, Thai, Portuguese, French)NYSE: XPROOUR TIME OUR FUTURE OUR PEOPLE1.31 47% >7.2KTotal Recordable R&D spend on reducing Employees Case Frequency customers’ carbon (TRCF) reduction challenges in 2022 60 0.46 Countries Lost Time Incident Frequency (LTF)75NationalitiesStrong Cash flow outlookDebt-free balance sheet with significant liquidity2 Copyright 2022 Expro. All rights reserved.

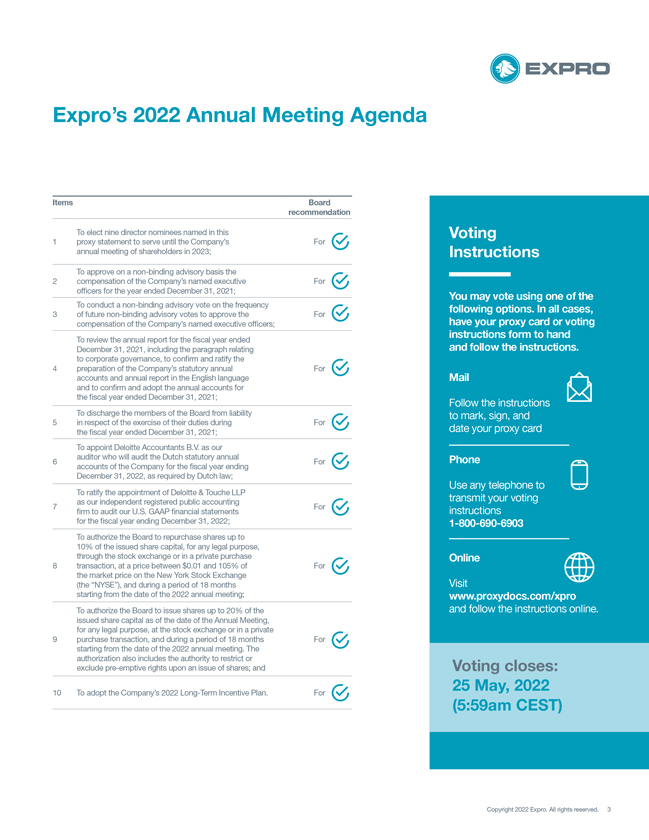

Expro’s 2022 Annual Meeting AgendaItems Board recommendationTo elect nine director nominees named in this1 proxy statement to serve until the Company’s For annual meeting of shareholders in 2023;To approve on a non-binding advisory basis the2 compensation of the Company’s named executive For officersA DIVERSE SET OF GLOBAL CAPABILITIES IN: Delivering technology, Unlocking expertise & service energy answers for the year ended December 31, 2021; To conduct a non-binding advisory vote on the frequency 3wells for tomorrow of future non-binding advisory votes to approve the For compensation of the Company’s named executive officers; To review the annual report for the fiscal year ended December 31, 2021, including the paragraph relating to corporate governance, to confirm and ratify the 4 preparation of the Company’s statutory annual For accounts and annual report in the English language and to confirm and adopt the annual accounts for the fiscal year ended December 31, 2021; To discharge the members of the Board from liability 5 in respect of the exercise of their duties during For the fiscal year ended December 31, 2021; To appoint Deloitte Accountants B.V. as our auditor who will audit the Dutch statutory annual6 For accounts of the Company for the fiscal year ending December 31, 2022, as required by Dutch law; To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting7 For firm to audit our U.S. GAAP financial statements for the fiscal year ending December 31, 2022; To authorize the Board to repurchase shares up to 10% of the issued share capital, for any legal purpose, through the stock exchange or in a private purchase 8 transaction, at a price between $0.01 and 105% of For the market price on the New York Stock Exchange (the “NYSE”), and during a period of 18 months starting from the date of the 2022 annual meeting; To authorize the Board to issue shares up to 20% of the issued share capital as of the date of the Annual Meeting, for any legal purpose, at the stock exchange or in a private 9 purchase transaction, and during a period of 18 months For starting from the date of the 2022 annual meeting. The authorization also includes the authority to restrict or exclude pre-emptive rights upon an issue of shares; and10 To adopt the Company’s 2022 Long-Term Incentive Plan. ForVoting InstructionsYou may vote using one of the following options. In all cases, have your proxy card or voting instructions form to hand and follow the instructions.MailFollow the instructions to mark, sign, and date your proxy cardPhoneUse any telephone to transmit your voting instructions1-800-690-6903OnlineVisit www.proxydocs.com/xpro and follow the instructions online.Voting closes:25 May, 2022 (5:59am CEST)Copyright 2022 Expro. All rights reserved. 3

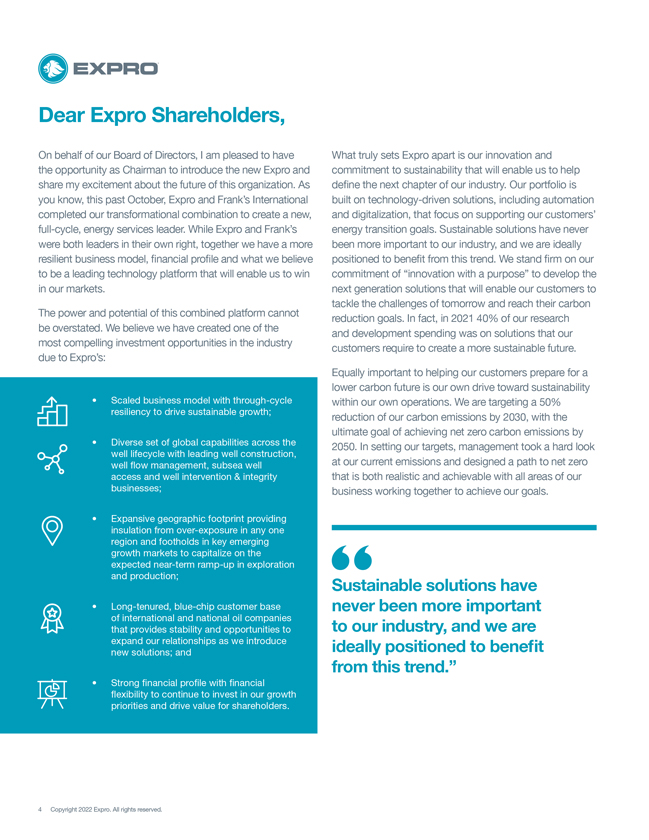

Dear Expro Shareholders,On behalf of our Board of Directors, I am pleased to have the opportunity as Chairman to introduce the new Expro and share my excitement about the future of this organization. As you know, this past October, Expro and Frank’s International completed our transformational combination to create a new, full-cycle, energy services leader. While Expro and Frank’s were both leaders in their own right, together we have a more resilient business model, financial profile and what we believe to be a leading technology platform that will enable us to win in our markets.The power and potential of this combined platform cannot be overstated. We believe we have created one of the most compelling investment opportunities in the industry due to Expro’s:• Scaled business model with through-cycle resiliency to drive sustainable growth;• Diverse set of global capabilities across the well lifecycle with leading well construction, well flow management, subsea well access and well intervention & integrity businesses;• Expansive geographic footprint providing insulation from over-exposure in any one region and footholds in key emerging growth markets to capitalize on the expected near-term ramp-up in exploration and production;• Long-tenured, blue-chip customer base of international and national oil companies that provides stability and opportunities to expand our relationships as we introduce new solutions; and• Strong financial profile with financial flexibility to continue to invest in our growth priorities and drive value for shareholders.What truly sets Expro apart is our innovation and commitment to sustainability that will enable us to help define the next chapter of our industry. Our portfolio is built on technology-driven solutions, including automation and digitalization, that focus on supporting our customers’ energy transition goals. Sustainable solutions have never been more important to our industry, and we are ideally positioned to benefit from this trend. We stand firm on our commitment of “innovation with a purpose” to develop the next generation solutionsthat will enable our customers to tackle the challenges of tomorrow and reach their carbon reduction goals. In fact, in 2021 40% of our research and development spending was on solutions that our customers require to create a more sustainable future.Equally important to helping our customers prepare for a lower carbon future is our own drive toward sustainability within our own operations. We are targeting a 50% reduction of our carbon emissions by 2030, with the ultimate goal of achieving net zero carbon emissions by 2050. In setting our targets, management took a hard look at our current emissions and designed a path to net zero that is both realistic and achievable with all areas of our business working together to achieve our goals.Sustainable solutions have never been more important to our industry, and we are ideally positioned to benefit from this trend.”4 Copyright 2022 Expro. All rights reserved.

We are committed to a culture that promotes diversity and inclusivity, reinforces our high safety standards and empowers each of our employees to take ownership of their responsibilities to help them grow so we can succeed together.”Underpinning all of this is a commitment to strong governance practices to ensure we are doing right by our shareholders, our team, our customers and our communities. This starts with assembling a Board of diverse, independent directors. Our Board brings a wealth of expertise and experience from both Frank’s and legacy Expro, and is united in its mission to take action to advance shareholders’ best interests and maintain an ESG program that aligns with the highest standards. A small but powerful indication of the Board’s commitment to ESG practices is our recent renaming of the Nominating and Governance Committee to the ESG Committee, as well as amending its charter to add certain duties surrounding ESG and enterprise risk assessment oversight.As you review the following materials, please note the policies we have implemented to ensure the interests of the Board and management team are aligned with those of all shareholders. This includes a performance-based executive compensation program with clear performance targets that will serve to create sustainable growth in shareholder value.We also understand that our success is only possible because of the incredible team we have assembled. We are committed to a culture that promotes diversity and inclusivity, reinforces our high safety standards and empowers each of our employees to take ownership of their responsibilities to help them grow so we can succeed together.While we are a new company in one sense, we possess the numerous historic strengths of two long-standing global players with complementary cultures. Our focus on innovation, sustainability, safety and technological excellence has created an even stronger industry leader. Expro is poised for sustainable growth and substantial shareholder value creation. As we begin this next phase of our journey, I look forward to continuing to update you as we capitalize on the incredible power of the Expro platform.I would like to close by thanking Keith Mosing for his decades of service to Frank’s International. Keith will be retiring from the Board at this upcoming Annual General Meeting. Through Keith’s initiative, he pioneered and drove the creation of the international business of Frank’s, which grew over the years to become the largest and most profitable part of Frank’s International. As CEO, Keith led Frank’s to become the worldwide leader in tubular running services and a company respected for its employees, their impeccable customer service, and highly innovative technology.On behalf of your Board, thank you for your continued support and investment in Expro.Sincerely,Michael C. Kearney, ChairmanCopyright 2022 Expro. All rights reserved. 5

About UsWe are a full-cycle energy services provider. We combine innovative, future-facing technology with high quality information flow across Well Construction, Well Flow Management, Subsea Well Access and Well Intervention and Integrity.Well ConstructionInnovative, high value, low risk well construction solutions with a focus on operational efficiency and well integrity.Well Management FlowProficient gathering of valuable well and reservoir data, with the utmost regard for well-site safety and environmental impact.Subsea Access WellSafe, efficient and cost-effective subsea well access solutions across the entire lifecycle of the well.Well Intervention and IntegrityDeployment, insight and enhancement solutions to enable reservoir and well surveillance, production optimization and asset integrity assurance.Our BusinessWith roots dating to 1938, the Company is a leading provider of energy services, offering cost-effective, innovative solutions and what the Company considers to be best-in-class safety and service quality. The Company’s extensive portfolio of capabilities spans well construction, well flow management, subsea well access, and well intervention and integrity solutions. The Company provides services in many of the world’s major offshore and onshore energy basins, with over 100 locations and operations in approximately 60 countries.Expro’s broad portfolio of products and services provides cost-effective solutions to enhance production and improve recovery across the well lifecycle from exploration through abandonment, including:Well Construction• Well Construction: Our well construction products and services support customers’ new wellbore drilling, wellbore completion and recompletion, and wellbore plug and abandonment requirements.Well Management• Well flow management: We gather valuable well and reservoir data, with a particular focus on well-site safety and environmental impact.• Subsea well access: We have over 35 years of experience providing a wide range of fit-for-purpose subsea well access solutions throughout the lifecycle of the well. We also provide systems integration and project management services.• Well intervention and integrity: We provide well intervention solutions to capture well data, ensure well bore integrity and improve production.OVER100 LOCATIONSandOPERATIONSin more than60 COUNTRIES.

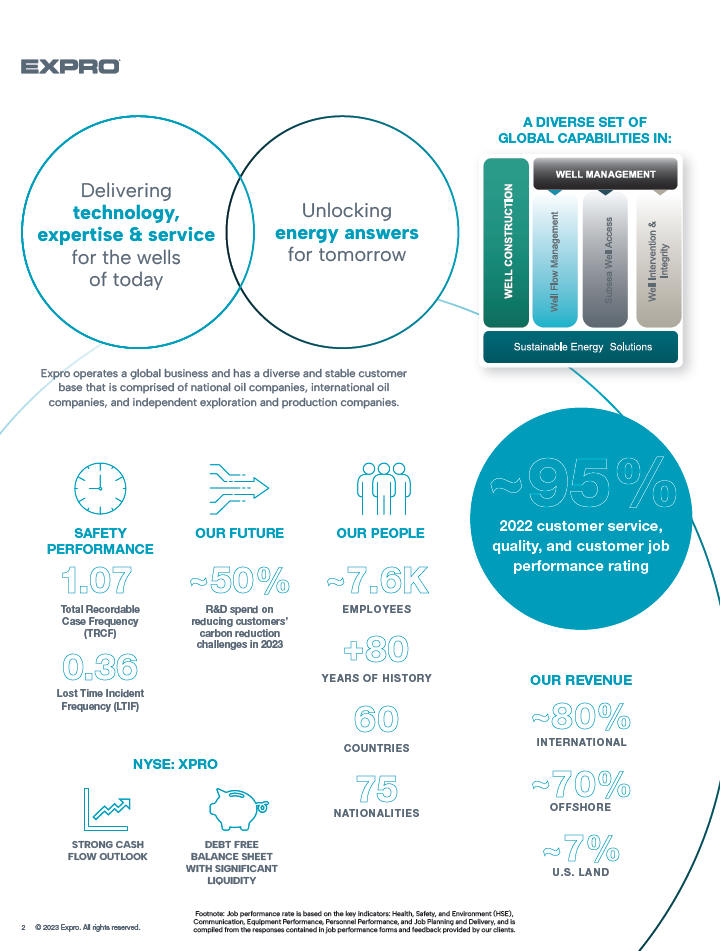

today Expro operates a global business and has a diverse and stable customer base that is comprised of national oil companies, international oil companies, and independent exploration and production companies.6 Copyright 95% 2022 customer service, SAFETY OUR FUTURE OUR PEOPLE PERFORMANCE quality, and customer job performance rating 1.07 50%~7.6K Total Recordable R&D spend on EMPLOYEES Case Frequency reducing customers’ (TRCF) carbon reduction challenges in 2023 +80 0.36 YEARS OF HISTORY OUR REVENUE Lost Time Incident Frequency (LTIF) 80% 60 INTERNATIONAL COUNTRIES NYSE: XPRO ~ 75 70% NATIONALITIES OFFSHORE STRONG CASH DEBT FREE FLOW OUTLOOK BALANCE SHEET 7% WITH SIGNIFICANT U.S. LAND LIQUIDITY 2 © 2023 Expro. All rights reserved. Footnote: Job performance rate is based on the key indicators: Health, Safety, and Environment (HSE), Communication, Equipment Performance, Personnel Performance, and Job Planning and Delivery, and is compiled from the responses contained in job performance forms and feedback provided by our clients.

Dear Expro Shareholders,

We have earned our global reputation as the “well experts” and a trusted partner to customers. Demand for our services and solutions continues to increase, and our business is purpose-built to take full advantage of favorable tailwinds that we expect to persist for the next several years as energy market fundamentals continue to strengthen. We are confident that we will drive accelerated shareholder value creation built upon our solid foundation:

| • | We are strongly positioned to support accelerating upstream activity with our leading positions in complex well construction, subsea landing strings, well testing and fast-track production facilities. |

| • | Our comprehensive portfolio of technologically differentiated solutions and our broad geographic footprint allow us to serve customers in key growth markets and continue to win business at every step of our customers’ well lifecycle journey. |

| • | We have continued to invest in our innovative portfolio to develop new solutions that solve customers’ key needs - namely cost-efficiency and sustainability. |

| • | With our debt free balance sheet and disciplined cost structure, Expro is built to maintain profitability through market cycles and accelerate cash flow generation in periods of strong activity. |

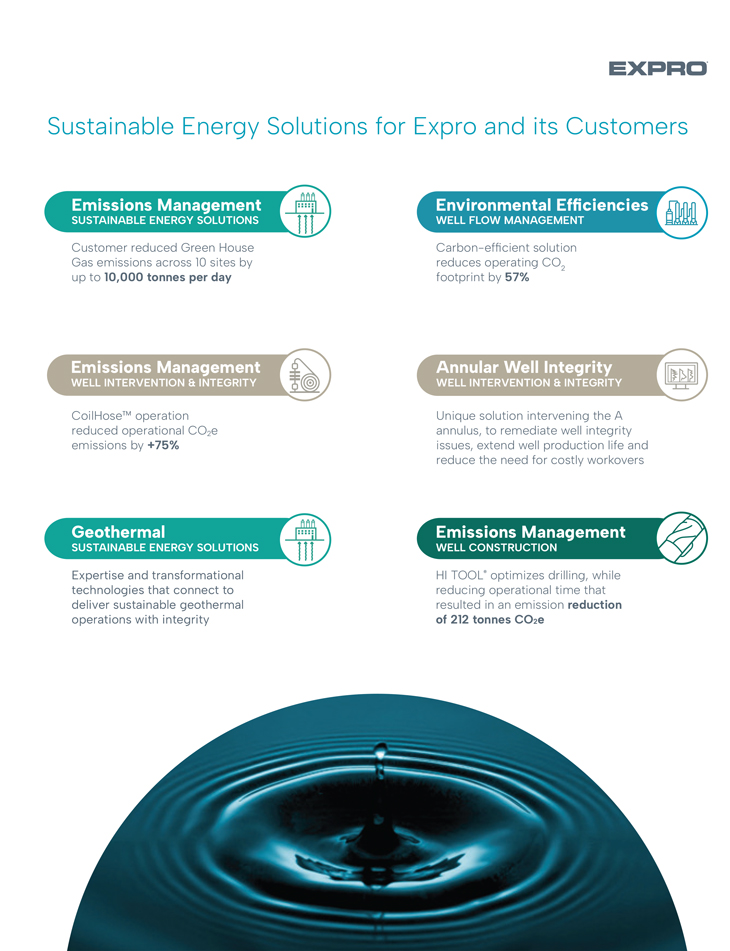

Our strategy is rooted in supporting sustainability - for our company, our customers and our planet. In 2022, we published our inaugural ESG Report that provides a comprehensive picture of our sustainability initiatives and goals. In recognition of our efforts, we were proud to receive a two-position upgrade to single-A from MSCI, a leading ESG rating agency.

Our sustainability goals include our plan to continue to invest in transforming our business portfolio and reducing our greenhouse gas emissions to achieve our target of a 50% reduction in carbon intensity by 2030 and Net Zero carbon emissions by 2050. To advance these goals, we invested 50% of our 2022 R&D budget into sustainable solutions. We expect to expand investments in this area to well over 50% of our budget this year.

Our significant progress on our business initiatives and ESG efforts is due to the strength of our greatest asset - the Expro team. We continue to enhance our Quality, Heath, Safety and Environmental | Social | Governance (ESG)Environment

(QHSE) program to foster a safer, healthier and more sustainable environment for Expro employees, customers and anyone with whom we do business. We celebrate the diversity of our global team and empowering employees to play a role in creating better tomorrows for our communities.

The Expro Board believes that leadership starts at the top with strong governance and the right mix of Board skills and experience. In an effort to ensure we have new perspectives in our ongoing oversight of management’s strategy and shareholder interests, we will periodically add new directors. As such, the Company announces that the Board has appointed Ms. Frances Vallejo as the newest independent director. Ms. Vallejo is a former executive officer of ConocoPhillips, an independent exploration and production company, where she began her career in 1987 and held extensive leadership roles in corporate planning, budgeting, and treasury.

On behalf of the entire Board and management team, I would also like to extend our deepest gratitude to Erich Mosing, who will be stepping down from the Board at this year’s Annual Meeting. The Mosing family founded Frank’s, and over the company’s history of more than 80 years, the Mosings and the Frank’s employees have worked tirelessly to build it into an industry leader. Since our combination, Erich has been a guiding force in our integration efforts. We thank him and his family for all they have done to lay the foundation for the Expro we have today.

Finally, I would like to thank our employees, customers and shareholders for their loyal support. Expro is committedpoised for continued profitable growth, and I look forward to preventing harm towatching the environment and promoting sustainable practices. The depletion of natural resources and the threat of climate change raise legitimate concerns about the environment and the potential financial impact on businesses. Sustainable options are increasingly being considered.SocialWeCompany drive value diversity in our workforce, and in our customers, suppliers, and others. We provide equal employment opportunitycreation for all applicants and employees. We want to attract, develop and retain the best talent to create a diverse and inclusive working environment, where everyone is accepted, valued and treated fairly without discrimination.Our approach to human rights is guided by international standards. We are committed to embedding respect for human rights throughout all aspects of our business and within all geographies in which we operate.We engage with local communities, not only to reduce the impact of our operations, but also to positively impact such communities where possible. The impact that a company has on its employees, local communities and society are a key area of focus.The issues are diverse, but the main areas are:• Factors contributing to climate change• Efficient energy consumption• Responsible disposal of hazardous waste• Sustainability of resources• The impact of climate change on businessesThe main areas of consideration are:• Preservation of human rights and avoidance of any complicity in human rights abuses• Equality and diversity amongst employees• Non-discriminatory employment practices• Working to eliminate exploitation of child labor or indentured servitude• Health and safetyCorporate GovernanceWe are committed to doing business ethically and transparently, using our values and code of conduct to guide us. As a trusted business, we work to a consistent and high standard wherever we operate in the world, including strong anti-bribery, anti-corruption and supply chain standards and financial transparency.Our corporate governance framework addresses the responsibilities of the management of a company, its structures, corporate values and accountability processes.This relates to the following areas:• Our Board and Management structure• Our employees and workplace culture• Executive compensation practices• Compliance with our corporate and supplier codes of conduct• Transparency and accountability• Engagement with our customers, suppliers, communities and other relevant stakeholders• Seeking to comply with and inform industry standard ESG guidelines and best practices• Monitoring and reporting on ESG data relevant to our operations, including energy use, emissions, safety and other relevant metrics aimed at aligning with TCFD and SASB frameworksCopyright 2022 Expro. All rights reserved. 7

2022 Annual Meeting Key InformationBoard PracticesWe are committed to governing the company in accordance with best practices.The Chairman of the Board Directors are elected by a is a non-executive director simple majority vote standardThe Board conducts an annual Six of nine Board members self-evaluation to determine are independent whether it is functioning effectivelyAll Board members are The non-management directors elected annually have regularly scheduled meetings in executive sessionRisk OversightThe Board is actively involved in oversight of risks that could affect the Company. This oversight function is conducted primarily through the Audit Committee and the ESG Committee, but the full Board retains responsibility for general oversight of risks.The Audit Committee is charged with oversight of the Company’s system of internal controls and risks relating to financial reporting, legal, regulatory and accounting compliance.The ESG Committee, formerly the Nominating and Governance Committee, is charged with oversight of risks related to environmental, social and governance matters, including climate- and human capital-related risks,shareholders, as well as enterprise risk management, andbecome the assessment of enterprise and strategic risks, including cybersecurity risks.8 Copyright 2022 Expro. All rights reserved.

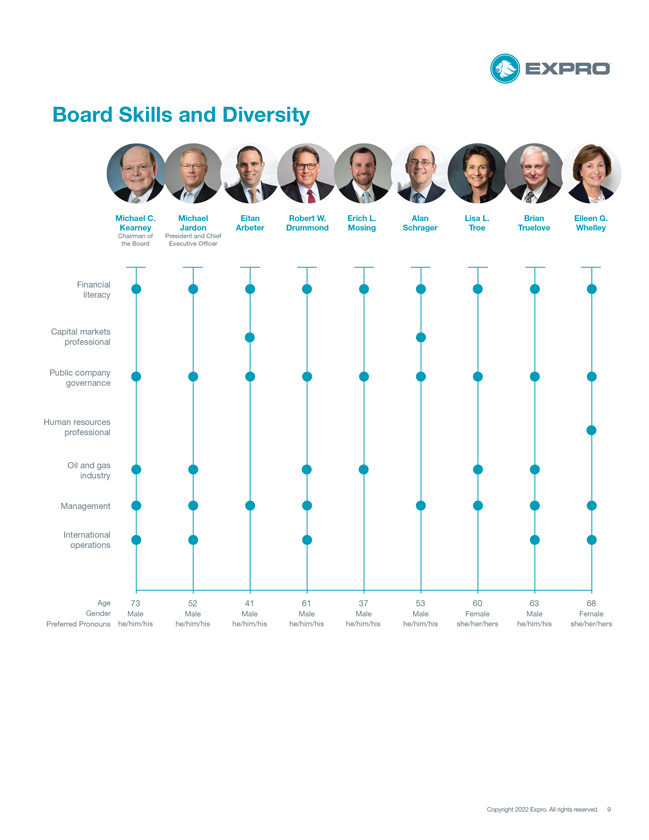

Board Skills and DiversityMichael C. KearneyChairman of the BoardMichael JardonPresident and Chief Executive OfficerEitanArbeterRobert W. DrummondErich L. MosingAlan SchragerLisa L. TroeBrianTrueloveEileen G. WhelleyFinancial literacyCapital markets professionalPublic company governanceHuman resources professionalOil and gas industryManagementInternational operationsAge 73 52 41 61 37 53 60 63 68Gender Male Male Male Male Male Male Female Male Female Preferred Pronouns he/him/his he/him/his he/him/his he/him/his he/him/his he/him/his she/her/hers he/him/his she/her/hersCopyright 2022 Expro. All rights reserved. 9

Executive CompensationThe Compensation Committee has primary responsibility for our executive compensation program, including decisions regarding the various levels and forms of compensation for each of the Company’s Named Executive Officers following the Merger. The Compensation Committee’s primary objectives are to:• Set competitive pay practices• Retain and motivate executives during integration period and beyond;• Utilize equity compensation to align the incentives of new executives of the Company with the interests of shareholders;• Maintain continuity with prior compensation arrangements; and• Reward executives for their efforts in integrating the two companies.We continue to maintain executive compensation programs that reflect positive corporate governance features. Below is a summary of those practices:• Variable, at-risk, performance-based elements to align pay and performance• Multiple performance metrics across our short and long-term incentive plans• Maximum payout limited under our short- and long-term incentive plans• Stock ownership guidelines for officers and non-employee directors• Anti-hedging and anti-pledging policies• Engagement of an independent outside consultant to help the Committee evaluate and monitor the Company’s compensation program• Reasonable post-employment and change-in-control provisions• No single-trigger change-in-control payments or excise tax gross-ups• Clawback that appliesbest partner possible to all incentive compensation paid to our NEOs.Equity Incentive PlanOur use of equity is balanced and our plan is aligned with best practices:Encourage Long-Term Outlook:Long-term awards have three-year vesting periods.Pay for Performance: A significant portion of our executives’ equity is performance-based.Clawback Policy: We adopted a clawback policy that allows for recoupmentits stakeholders in the event of a material restatement of the Company’s financial statements.No Tax Gross-ups: The Plan does not provide for any tax gross-ups.Reasonable Dilution: Approximate dilution with approval of our share request is currently 10.1%.No Liberal Share Recycling: We prohibit liberal share recycling on stock options and stock appreciation rights.No Dividends, Distributions or Dividend Equivalents on Awards:We prohibit payment of dividends/ equivalents on unvested awards.Minimum Vesting Requirements:In general, awards granted under the Plan will include a one-year minimum vesting period.10 Copyright 2022 Expro. All rights reserved.2023.

| Sincerely, Michael C. Kearney, Chairman |

EXPRO GROUP HOLDINGS N.V.

1311 Broadfield Blvd., Suite 400

Houston, Texas 77084

(Incorporated in The Netherlands)

To the shareholders of Expro Group Holdings N.V.:

You are cordially invited to attend the annual meeting of the shareholders of Expro Group Holdings N.V. (the “Company”) to be held on May 25, 2022,24, 2023, at 4:00 p.m. Central European Time (“CET”), at the offices of Van Campen Liem, J.J. Viottastraat 52, 1071 JT, Amsterdam, The Netherlands. This annual meeting has been called by the Company’s board of directors (the “Board”). At this meeting, you will be asked to consider and vote upon the following proposals:

|

|  | ||

Date & Time: Wednesday May 24, 2023 4:00 p.m., Central European Time | Place: The Offices of Van Campen Liem, J.J. Viottastraat 52, 1071 JT, Amsterdam, The Netherlands | Record Date: April 26, 2023 | ||

How to Vote | ||||||||

|  |  | ||||||

Online Vote online at www.proxyvote.com. | By Phone Vote by phone by calling the number located on your | By Mail If you received a printed version of these proxy | ||||||

Your vote is very important. Holders of the Company’s shares of common stock, each with a nominal value of €0.06 (the “Common Stock”), held as of April 26, 2023, the “day of registration” (“dag van registratie”) as referred to in the Dutch Civil Code, are entitled to vote on the matters before the annual meeting. Even if you plan to attend the annual meeting, the Company urges you to promptly vote your shares of Common Stock in advance of the annual meeting. You will retain the right to revoke your proxy at any time before the vote, or to vote your shares of Common Stock personally if you attend the annual meeting. Voting your shares of Common Stock in advance of the annual meeting will not prevent you from attending the annual meeting and voting in person. Please note, however, that if you hold your shares of Common Stock through a broker or other nominee, and you wish to vote in person at the annual meeting, you must obtain from your broker or other nominee a proxy issued in your name. | ||||||||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 24, 2023 The Notice of Annual Meeting of Shareholders and the Proxy Statement for the 2023 Annual Meeting of Shareholders, along with the Company’s 2022 Annual Report to Shareholders, is available free of charge at www.proxydocs.com/xpro. |

| 2023 Proxy Statement |

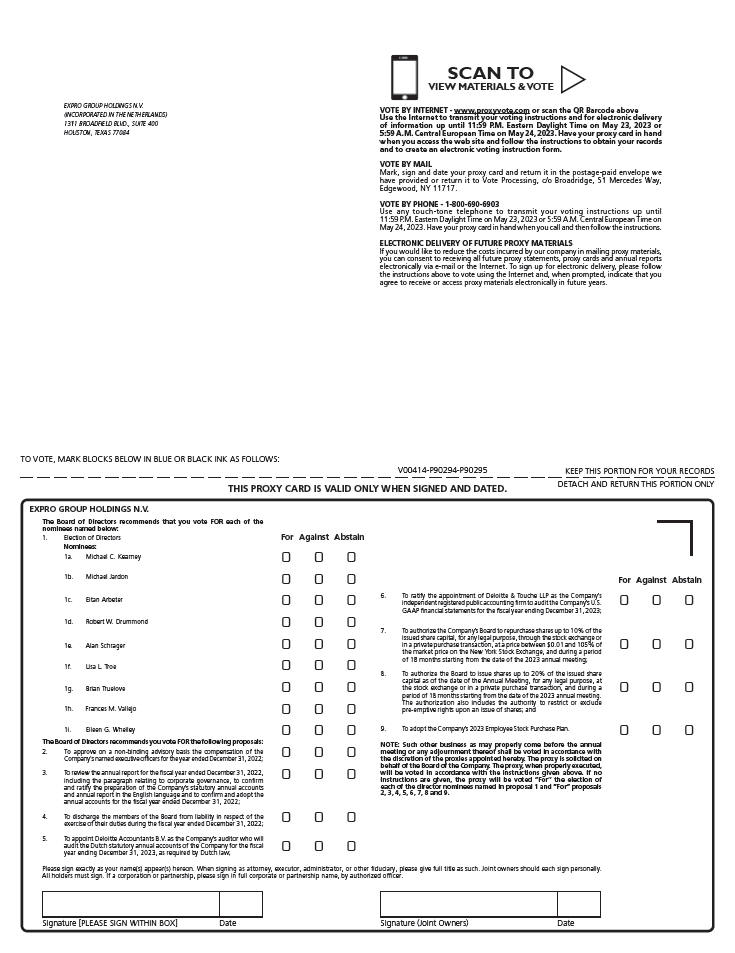

At this meeting, you will be asked to consider and vote upon the following proposals:

Voting Matters | For More | Voting | ||||

| 1. | To elect nine director nominees named in this proxy statement to serve until the Company’s annual meeting of shareholders in | |||||

Page 64 | FOR | |||||

| 2. | To approve on a non-binding advisory basis the compensation of the Company’s named executive officers for the year ended December 31, | |||||

|

FOR | ||||||

| 3. | To review the annual report for the fiscal year ended December 31, | |||||

Page 66 | FOR | |||||

| 4. | To discharge the members of the Board from liability in respect of the exercise of their duties during the fiscal year ended December 31, | |||||

Page 67 | FOR | |||||

| 5. | To appoint Deloitte Accountants B.V. as our auditor who will audit the Dutch statutory annual accounts of the Company for the fiscal year ending December 31, | |||||

Page 68 | FOR | |||||

| 6. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to audit our U.S. GAAP financial statements for the fiscal year ending December 31, | |||||

Page 69 | FOR | |||||

| 7. | To authorize the Board to repurchase shares up to 10% of the issued share capital, for any legal purpose, through the stock exchange or in a private purchase transaction, at a price between $0.01 and 105% of the market price on the New York Stock Exchange (the “NYSE”), and during a period of 18 months starting from the date of the | |||||

Page 70 | FOR | |||||

| 8. | To authorize the Board to issue shares up to 20% of the issued share capital as of the date of the | |||||

Page 71 | FOR | |||||

| 9. | To adopt the Company’s | |||||

Page 72 | FOR | |||||

10. | To transact such other business as may properly come before the annual meeting or any adjournment thereof. | |||||

Your vote is very important. Holders of the Company’s shares of common stock, each with a nominal value of €0.06 (the “Common Stock”), held as of April 27, 2022, the “day of registration” (“dag van registratie”) as referred to in the Dutch Civil Code, are entitled to vote on the matters before the annual meeting. Even if you plan to attend the annual meeting, the Company urges you to promptly vote your shares of Common Stock in advance of the annual meeting. You will retain the right to revoke your proxy at any time before the vote, or to vote your shares of Common Stock personally if you attend the annual meeting. Voting your shares of Common Stock in advance of the annual meeting will not prevent you from attending the annual meeting and voting in person. Please note, however, that if you hold your shares of Common Stock through a broker or other nominee, and you wish to vote in person at the annual meeting, you must obtain from your broker or other nominee a proxy issued in your name.

Pursuant to the “notice and access” rules promulgated by the Securities and Exchange Commission (“SEC”), we are also providing access to our proxy materials over the Internet. As a result, we are mailing to most of our shareholders a Notice of Internet Availability of Proxy Materials (the “Notice”) instead of a paper copy of this proxy statement, a proxy card and our 20212022 annual report. The Notice contains instructions on how to access those documents over the Internet, as well as instructions on how to request a paper copy of our proxy materials. We believe that this process will allow us to provide you with the information you need in a timelier manner, will save us the cost of printing and mailing documents to you, and will conserve natural resources.

I urge you to review carefully the proxy statement, which contains detailed descriptions of the proposals to be voted upon at the annual meeting.

Sincerely,

John McAlister

General Counsel and Secretary

Den Helder, The Netherlands

, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 25, 2022

The Notice of Annual Meeting of Shareholders and the Proxy Statement for the 2022 Annual Meeting of Shareholders, along with the Company’s 2021 Annual Report to Shareholders, is available free of charge at www.proxydocs.com/xpro.March 31, 2023

TABLE OF CONTENTS

i

EXPRO GROUP HOLDINGS N.V.

1311 Broadfield Blvd., Suite 400

Houston, Texas 77084

(Incorporated in The Netherlands)

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

, 2022March 31, 2023

This proxy statement is being furnished to you in connection with the solicitation of proxies by the Board of the Company for use at the Company’s annual meeting.

In this proxy statement, unless indicated otherwise, “we,” “our,” “us,” “Expro,” and the “Company” refer to Expro Group Holdings N.V. (including when it was formerly known as Frank’s International N.V.). References to “Legacy Expro” refer to Expro Group Holdings International Limited, the entity acquired by the Company in the Merger (as defined below).

On March 10, 2021, the Company and New Eagle Holdings Limited, a wholly owned subsidiary of the Company (“Merger Sub”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Legacy Expro providing for the merger of Legacy Expro with and into Merger Sub in an all-stock transaction, with Merger Sub surviving the merger as a direct, wholly owned subsidiary of the Company (the “Merger”). The Merger closed on October 1, 2021, and the Company was renamed “Expro Group Holdings N.V.” Pursuant to the Merger Agreement, the articles of association of the Company (the “Articles”) were amended to increase the total authorized capital stock of the Company and to effect certain other amendments to the Articles contemplated by the Merger Agreement, including to replace the Company’s Supervisory Board of Directors and the Company’s Management Board of Directors with a single Board of Directors (the “Board”).Directors.

In connection with the Merger, Michael Kearney stepped down from his role as President and Chief Executive Officer of the Company. Mr. Kearney continues to serve as the Company’s Chairman of the Board. Further, in connection with the Merger, Michael E. McMahon, Kirkland D. Mosing, Melanie M. Trent, Alexander Vriesendorp, Erich L. Mosing, and L. Don Miller departed as directors of the Company’s Supervisory Board of Directors and Steven Russell, Melissa Cougle and John Symington departed as directors of the Company’s Management Board of Directors.

On October 1, 2021, the Board confirmed the appointments authorized at the General Meeting of the Shareholders of the Company held on September 10, 2021, appointing Michael Jardon as an executive director of the Board and the following individuals as non-executive directors of the Board: Michael Kearney,As further described below, Eitan Arbeter, Alan Schrager Lisa Troe, Brian Truelove, Eileen Whelley, Keith Mosing and Robert Drummond. As further described below, Mr. Arbeter, Mr. Schrager and Mr.Erich L. Mosing were appointed pursuant to a director nomination agreement entered into in connection with the Merger Agreement between the Company and certain shareholders of the Company and Legacy Expro (the “Director Nomination Agreement”). Ms. Troe, Mr. TrueloveOn January 18, 2023, certain funds and Ms. Whelley were appointed to serve onaccounts managed by Oak Hill Advisors, L.P. sold 9,200,000 shares of Common Stock in an underwritten public offering. Following the Company’s Audit Committee. Mr. Drummond, Mr. Arbeter and Ms. Whelley were appointed to serve onoffering, the Company’s Compensation Committee. Mr. Truelove, Ms. Troe and Mr. Drummond were appointed to serve on the Company’s ESG Committee. Mr. Keith Mosing is not standing for re-election and, therefore, retiring at the 2022 annual meeting. Pursuant to the Director Nomination Agreement, Mr. Erich L. Mosing, a former supervisory director of the Company, has been designated by the Mosing PartiesOak Hill Group (as defined in the Director Nomination Agreement) has the right to replaceappoint one director to the Board. Mr. Keith MosingArbeter was appointed pursuant to this right under the Director Nomination Agreement and will be the Oak Hill Group’s designee at the 2023 annual meeting. Mr. Schrager was nominated to the Board for re-election at the 2023 annual meeting as a non-executive director due to his extensive familiarity with Legacy Expro and his experience with its institutional investors.

The Company was notified by the Mosing Representative that the Mosing Family Members (each as defined in the Director Nomination Agreement) were unable to provide confirmation of their continuing to collectively own shares of Common Stock equal to at least 10% of the Board.total shares outstanding at the closing of the Merger. As such, Mr. Erich Mosing will not stand for re-election at the 2023 annual meeting.

Moreover, in light of her vast experience in the oil and gas industry and extensive leadership roles in corporate planning, budgeting, and treasury, the Board has nominated Frances M. Vallejo for election at the 2023 annual meeting.

Our Common Stock is traded on the NYSE. Therefore, in accordance with rules and regulations adopted by the SEC, we are providing our stockholders access to our proxy materials on the Internet. Accordingly, the

Notice will be mailed to the Company’s shareholders of record as of March 21, 202220, 2023 on or about , 2022.March 31, 2023. Shareholders will have the ability to access the proxy materials on a website referred to in the Notice or request a printed set of the proxy materials to be sent to them by following the instructions in the Notice.

| 2023 Proxy Statement | 1 |

QUESTIONS AND ANSWERS

Shareholders are urged to carefully read this proxy statement in its entirety. FOR COPIES OF THIS PROXY STATEMENT, OR IF YOU HAVE ANY QUESTIONS ABOUT THE ANNUAL MEETING OR NEED ASSISTANCE VOTING, PLEASE CONTACT OUR INVESTOR RELATIONS DEPARTMENT AT INVESTORRELATIONS@EXPRO.COM.

| Q: | When and where is the annual meeting? |

| A: | The annual meeting will be held on May |

| Q: | Who is soliciting my proxy? |

| A: | The Board is sending you this proxy statement in connection with their solicitation of proxies for use at the Company’s |

| Q: | Who is entitled to vote at the annual meeting? |

| A: | All shareholders who own shares of Common Stock as of the record date, April |

Each shareholder is entitled to one vote for each share of Common Stock owned by them on the record date, April 27, 2022,26, 2023, on all matters to be considered. On March 21, 2022, 109,378,74820, 2023, 108,989,656 shares of Common Stock were outstanding.

The Company is sending the Notice to shareholders of record as of March 21, 2022,20, 2023, which we established as the notice date to comply with applicable deadlines for purposes of compliance with the SEC and NYSE proxy solicitation rules. However, receipt of the Notice does not, by itself, entitle you to vote at the annual meeting.

| Q: | What vote is required to approve the proposals? |

| A: | The affirmative vote of a simple majority of the votes cast is required to elect each director nominee and to approve each item on the agenda at the annual meeting. Under Dutch law, there is no required quorum for shareholder action at a properly convened shareholder meeting. Further, a director nominee proposal made by the Board submitted on time is binding. However, the general meeting may render the proposal non-binding by a resolution to that effect adopted with a majority of no less than two-thirds of the votes cast, representing over one-half of the issued capital. |

A properly executed proxy (for a holder as of the record date of the annual meeting) will be voted in accordance with the instructions on the proxy. If you properly complete and submit a proxy, but do not indicate any contrary voting instructions, your shares will be voted as follows:

“FOR” the election of each of the director nominees named in this proxy statement (“Item One”);

“FOR” the approval on a non-binding advisory basis of the compensation of the Company’s named executive officers (“Item Two”);

“FOR” a frequency of “1 Year” for future non-binding advisory votes to approve the compensation of the Company’s named executive officers (“Item Three”);

“FOR” the confirmation and ratification of the preparation of the Company’s statutory annual accounts and annual report in the English language and the confirmation and adoption of the annual accounts for the fiscal year ended December 31, 2021 (“Item Four”);

“FOR” the discharge of the members of the Board from liability in respect of the exercise of their duties during the fiscal year ended December 31, 2021 (“Item Five”);

“FOR” the appointment of Deloitte Accountants N.V. as our auditor who will audit the Dutch statutory annual accounts of the Company for the fiscal year ending December 31, 2022 as required by Dutch law (“Item Six”);

“FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to audit our U.S. GAAP financial statements for the fiscal year ending December 31, 2022 (“Item Seven”);

“FOR” the authorization of the Company’s Board to repurchase shares up to 10% of the issued share capital, for any legal purpose, through the stock exchange or in a private purchase transaction, at a price between $0.01 and 105% of the market price on the NYSE, and during a period of 18 months starting from the date of the 2022 annual meeting (“Item Eight”);

“FOR” the authorization of the Board to issue shares up to 20% of the issued share capital as of the date of the Annual Meeting, for any legal purpose, at the stock exchange or in a private purchase transaction, and during a period of 18 months starting from the date of the 2022 annual meeting. The authorization also includes the authority to restrict or exclude pre-emptive rights upon an issue of shares (“Item Nine”); and

“FOR” the authorization of the Company’s 2022 Long-Term Incentive Plan (“Item Ten”).

| • | “FOR” the election of each of the director nominees named in this proxy statement (“Item One”); |

| • | “FOR” the approval on a non-binding advisory basis of the compensation of the Company’s named executive officers (“Item Two”); |

| • | “FOR” the confirmation and ratification of the preparation of the Company’s statutory annual accounts and annual report in the English language and the confirmation and adoption of the annual accounts for the fiscal year ended December 31, 2022 (“Item Three”); |

| • | “FOR” the discharge of the members of the Board from liability in respect of the exercise of their duties during the fiscal year ended December 31, 2022 (“Item Four”); |

| • | “FOR” the appointment of Deloitte Accountants B.V. as our auditor who will audit the Dutch statutory annual accounts of the Company for the fiscal year ending December 31, 2023 as required by Dutch law (“Item Five”); |

| • | “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to audit our U.S. GAAP financial statements for the fiscal year ending December 31, 2023 (“Item Six”); |

2 | 2023 Proxy Statement |

|

QUESTIONS AND ANSWERS

| • | “FOR” the authorization of the Company’s Board to repurchase shares up to 10% of the issued share capital, for any legal purpose, through the stock exchange or in a private purchase transaction, at a price between $0.01 and 105% of the market price on the NYSE, and during a period of 18 months starting from the date of the 2023 annual meeting (“Item Seven”); |

| • | “FOR” the authorization of the Board to issue shares up to 20% of the issued share capital as of the date of the 2023 annual meeting, for any legal purpose, at the stock exchange or in a private purchase transaction, and during a period of 18 months starting from the date of the 2023 annual meeting. The authorization also includes the authority to restrict or exclude pre-emptive rights upon an issue of shares (“Item Eight”); and |

| • | “FOR” the authorization of the Company’s 2023 Employee Stock Purchase Plan (“Item Nine”). |

| Q: | Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

| A: | In accordance with SEC rules, we are providing access to our proxy materials over the Internet. As a result, we have sent a Notice instead of a paper copy of the proxy materials. The Notice contains instructions on how to access the proxy materials over the Internet and how to request a paper copy. In addition, shareholders may request to receive future proxy materials in printed form by mail or electronically by e-mail. A shareholder’s election to receive proxy materials by mail or e-mail will remain in effect until the stockholder terminates it. |

| Q: | Can I vote my stock by filling out and returning the Notice? |

| A: | No. The Notice will, however, provide instructions on how to vote by Internet, by telephone, by requesting and returning a paper proxy card, or by personally attending and voting at the annual meeting. |

| Q: | How can I access the proxy materials over the Internet? |

| A: | Your Notice, proxy card and/or voting instruction card will contain instructions on how to view our proxy materials for the annual meeting on the Internet. Our proxy materials are also available at www.proxydocs.com/xpro. |

|

How do I vote? |

| A: | If you are a shareholder of record as of April |

| • | Internet. Vote on the Internet at www.proxyvote.com. This website also allows electronic proxy voting using smartphones, tablets and other web-connected mobile devices (additional charges may apply pursuant to your service provider plan). Simply follow the instructions on the Notice, or if you received a proxy card by mail, follow the instructions on the proxy card and you can confirm that your vote has been properly recorded. If you vote on the Internet, you can request electronic delivery of future proxy materials. Internet voting facilities will be available 24 hours a day and will close at 11:59 p.m. Eastern Daylight Time (“EDT”) on May |

| • | Telephone. Vote by telephone by following the instructions on the Notice. Easy-to-follow voice prompts allow you to vote your shares of Common Stock and confirm that your vote has been properly recorded. Telephone voting facilities for shareholders will be available 24 hours a day and will close at 11:59 p.m. EDT on May |

| • | Mail. If you have requested and received a proxy card by mail, vote by mail by completing, signing, dating and returning your proxy card in the pre-addressed, postage-paid envelope provided. If you vote by mail and your proxy card is returned unsigned, then your vote cannot be counted. If you vote by mail and the returned proxy card is signed without indicating how you want to vote, then your proxy will be voted as recommended by the Board. If you mail in your proxy card, it must be received by the Company before the voting polls close at the annual meeting. |

| • | In person. You may attend and vote at the Annual Meeting. |

The Board recommends that you vote using one of the first three methods discussed above, as it is not practical for most shareholders to attend and vote at the annual meeting. Using one of the first three methods discussed above to vote will not limit your right to vote at the annual meeting if you later decide to attend in person.

| 2023 Proxy Statement | 3 |

QUESTIONS AND ANSWERS

If you are a beneficial owner of Common Stock held in street name, you must either direct your broker or other nominee as to how to vote your Common Stock, or obtain a “legal” proxy from your broker or other nominee to vote at the annual meeting. Please refer to the voter instruction card provided by your broker or other nominee for specific instructions on methods of voting.

Even if you plan to attend the annual meeting, please vote your proxy in advance of the annual meeting using one of the methods above as soon as possible so that your shares of Common Stock will be represented at the annual meeting if for any reason you are unable to attend in person.

| Q: | How can I attend the Annual Meeting if local public health restrictions in Amsterdam, The Netherlands, or elsewhere, do not permit me to attend the Annual Meeting? |

| A: | In light of the |

| Q: | What do I do if I want to change my vote after I have already voted by proxy? |

| A: | If you are a shareholder of record as of the record date, you may change or revoke your vote at any time before the voting polls close at the annual meeting by: |

| • | voting at a later time by Internet or telephone until 11:59 p.m. EDT on May 23, 2023, or 5:59 a.m. CET on May 24, 2023; |

| • | delivering a later-dated, executed proxy card to the address indicated in the envelope accompanying the proxy card; |

| • | delivering a written notice of revocation of your proxy to the Company, Attention: Corporate Secretary at 1311 Broadfield Blvd., Suite 400, Houston, Texas 77084; or |

| • | attending the annual meeting and voting in person. Please note that attendance at the annual meeting will not by itself (i.e., without also voting) revoke a previously granted proxy. |

voting at a later time by Internet or telephone until 11:59 p.m. EDT on May 24, 2022, or 5:59 a.m. CET on May 25, 2022;

delivering a later-dated, executed proxy card to the address indicated in the envelope accompanying the proxy card;

delivering a written notice of revocation of your proxy to the Company, Attention: Corporate Secretary at 1311 Broadfield Blvd., Suite 400, Houston, Texas 77084; or

attending the annual meeting and voting in person. Please note that attendance at the annual meeting will not by itself (i.e., without also voting) revoke a previously granted proxy.

If you are a beneficial owner of Common Stock held in street name and you have instructed your broker or other nominee to vote your Common Stock, you must follow the procedure your broker or other nominee provides to change those instructions. You may also vote in person at the annual meeting if you obtain a “legal” proxy from your broker or other nominee.

| Q: | If my shares of Common Stock are held in “street name” by my broker or other nominee, will my broker or other nominee vote my Common Stock for me? How do “abstentions” count? |

| A: | Brokers who hold shares in street name for customers are required to vote shares in accordance with instructions received from the beneficial owners. Brokers are permitted to vote on discretionary items if they have not received instructions from the beneficial owners, but they are not permitted to vote (a “broker non-vote”) on non-discretionary items absent instructions from the beneficial owner. |

4 | 2023 Proxy Statement |

|

QUESTIONS AND ANSWERS

| Q: | Who covers the expense of the proxy solicitation? |

| A: | The expense of preparing, printing and mailing the Notice and any proxy statement and the proxies solicited hereby will be borne by the Company. In addition to the use of the mail, proxies may be solicited by employees of the Company, without additional remuneration, by mail, phone, fax or in person. The Company will also request brokerage firms, banks, nominees, custodians and fiduciaries to forward proxy materials to the beneficial owners of the Company’s Common Stock as of March |

| the Americas, 24th Floor, New York, New York 10036. If you need assistance in completing your proxy card or voting by telephone or on the Internet, or have questions regarding the annual meeting, please contact Okapi Partners at |

| Q: | Are dissenters’ rights available to holders of Common Stock? |

| A: | Subject to certain exceptions, Dutch law does not recognize the concept of dissenters’ rights. Accordingly, dissenters’ rights are not available to the holders of the Company’s Common Stock with respect to matters to be voted upon at the annual meeting. |

| Q: | Who can I contact for further information? |

| A: | If you have questions or need assistance voting, please contact Investor Relations at investorrelations@expro.com. |

| 2023 Proxy Statement | 5 |

MANAGEMENT

Board Structure

The Company currently has a one-tier board structure, which Board under the Company’s Articles must consist of one or more executive directors and one or more non-executive directors. Only a non-executive director can serve as Chairman of the Board. This structure is customary for Dutch companies. Executive directors are primarily charged with the Company’s day-to-day operations and non-executive directors are primarily charged with the supervision of the performance of the duties of the directors. Prior to October 1, 2021, the Company had a two-tier board structure consisting of a board of managing directors and a separate board of supervisory directors.

The Board exercises oversight of management with the Company’s interests in mind. At the annual meeting, the terms of our nine incumbent directors will expire. Assuming the shareholders elect the nominees as set forth in “Item 1—Election of Directors,” the Board will continue to consist of nine members.

Directors and Executive Officers

Set forth below are the names and ages of the director nominees standing for election, as well as the names, ages and positions of the Company’s executive officers. All directors are elected for a term of one year or to serve until their successors are elected and qualified or upon earlier of death, disability, resignation or removal. All executive officers hold office until their successors are elected and qualified or upon earlier of death, disability, resignation or removal.

Other than Mr. Erich L. MosingMs. Vallejo (as described below), all of the director nominees are current directors whose appointments to the Board in October 2021 were confirmed by the Board, consistent with the authorization of their appointment at the 2021 general meeting of shareholders of the Company.directors. As described in greater detail on page 65, Messrs.61, Mr. Arbeter Schrager and Mosing werewas appointed pursuant to the Director Nomination Agreement. Specifically, pursuant to the Director Nomination Agreement, Mr. Erich L. Mosing, a former supervisory director of the Company, has been designated by the Mosing Parties (as defined in the Director Nomination Agreement) to replace Mr. Keith Mosing as a non-executive director of the Board. Mr. Keith Mosing is not standing for re-election at the 20222023 annual meeting. Ms. Troe and Ms. Whelley were recommendedVallejo was sourced by a third-party search firm.

|

| |||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

|

Michael C. Kearney. Mr. Kearney currently serves as the Company’s Chairman of the Boardfirm and non-executive director of the Board, a position he has held since October 2021. Mr. Kearney has over 25 years of upstream energy executive and board experience, principally in the oil services sector. Previously, Mr. Kearney

served as supervisory director from November 2013 until October 2021. He was Lead Supervisory Director from May 2014 until December 31, 2015, when he was named Chairman. From September 2017 until September 2021, he served as Chairman, President and Chief Executive Officer of the Company. In addition, he served on the Company’s Audit Committee from 2013 until 2017 and the Compensation Committee from 2014 until 2016. Mr. Kearney previously served as President and Chief Executive Officer of DeepFlex Inc., a privately held oil service company which was engaged in the manufacture of flexible composite pipe used in offshore oil and gas production, from September 2009 until June 2013, and had served as the Chief Financial Officer of DeepFlex Inc. from January 2008 until September 2009. Mr. Kearney served as Executive Vice President and Chief Financial Officer of Tesco Corporation from October 2004 to January 2007. From 1998 until 2004, Mr. Kearney served as the Chief Financial Officer and Vice President—Administration of Hydril Company. In addition to his executive experience, Mr. Kearney’s oil service experience extends to serving on the Board of Core Laboratories from 2004 until 2017, most recently as its Lead Director, and serving on the board and Audit Committee of Fairmount Santrol from 2015 until its merger with Unimin Corporation in 2018. Mr. Kearney currently serves on the board and Audit Committee of Ranger Energy Services, Inc., an independent provider of well service rigs and associated services, since 2018. He also serves on the board of directors for the Energy Workforce & Technology Counsel. Mr. Kearney received a Bachelor of Business Administration degree from Texas A&M University, as well as a Master of Science degree in Accountancy from the University of Houston. Mr. Kearney was selected as a director because of his experience in the oil and gas industry and his experience serving on the board of directors of other companies.

Michael Jardon. Mr. Jardon currently serves as the Company’s President and Chief Executive Officer and an executive member of the Company’s Board, positions he has held since October 2021. Prior to serving in his current positions, he was appointed Chief Executive Officer of Legacy Expro in April 2016, after five years as Legacy Expro’s Chief Operating Officer. Prior to joining Legacy Expro, he was Vice President Well Testing and Subsea responsible for North and South America at Schlumberger and held senior roles in wireline, completions, well testing and subsea from 1992 until 2008. He held a variety of assignments throughout North America, South America and the Middle East. He spent three years with Vallourec as President of North America, leading the commercial activities across North America, directing global research and development, as well as managing sales and strategy for the region. He holds a Bachelor of Science degree in Mechanical Engineering and Mathematics from Colorado School of Mines. Mr. Jardon was selected as a director because of his extensive experience and familiarity with Legacy Expro and its affiliates as well as his industry and management expertise.

Eitan Arbeter. Mr. Arbeter has been a non-executive member of the Company’s Board since October 2021. Mr. Arbeter previously served on the Board of Directors of Legacy Expro. He shares portfolio management responsibilities as Portfolio Manager and Partner at Oak Hill Advisors, L.P., a leading alternative investment firm. Mr. Arbeter serves on the Oak Hill Advisor’s investment strategy and several fund investment committees. Prior to assuming a portfolio management role, Mr. Arbeter spent over 10 years as a senior research analyst. Prior to joining Oak Hill Advisors, Mr. Arbeter worked at Bear, Stearns & Co. Inc. in its Global Industrials Group. He earned a B.B.A, with Honors, from the Stephen M. Ross School of Business at the University of Michigan. Mr. Arbeter was selected as a director because of his familiarity with Expro as well as his business acumen and capital markets expertise.

Robert W. Drummond. Mr. Drummond has been a director of the Company since May 2017. Prior to October 2021, he served as a supervisory director of the Company, and thereafter, as a non-executive member of the Company’s Board. He currently serves as President and Chief Executive Officer of NexTier Energy Solutions Inc., fka Keane Group, Inc., an oilfield services company, a position he has held since August 2018. He also serves on the Board of Directors of NexTier since August 2018. Prior to serving in his current position, Mr. Drummond served as President and Chief Executive Officer of Key Energy Services, Inc., an oilfield services company, from March 2016 to May 2018, prior to which he was President and Chief Operating Officer since June 2015. He also served on the Board of Directors of Key Energy Services, Inc. from November 2015 until August 2018. Prior to joining Key, Mr. Drummond was previously employed for 31 years by Schlumberger Limited, where he served in multiple engineering, marketing, operations, and leadership positions throughout

North America. His positions at Schlumberger included President of North America from January 2011 to June 2015; President of North America Offshore & Alaska from May 2010 to December 2010; Vice President and General Manager for the US Gulf of Mexico from May 2009 to May 2010; Vice President of Global Sales from July 2007 to April 2009; Vice President and General Manager for US Land from February 2004 to June 2007; Wireline Operations Manager from October 2003 to January 2004; Vice President and General Manager for Atlantic and Eastern Canada from July 2000 to September 2003; and Oilfield Services Sales Manager from January 1998 to June 2000. Mr. Drummond began his career in 1984 with Schlumberger. Mr. Drummond is a member of the Society of Petroleum Engineers and serves on the Advisory Board for the Energy Workforce & Technology Counsel and the University of Alabama College of Engineering Board. Formerly, he served as a member of the Board of Directors of the National Ocean Industries Association; the Board of Directors for the Greater Houston Partnership and on the Board of Trustees for the Hibernia Platform Employees Organization – Newfoundland; and as an advisory board member for each of the University of Houston Global Energy Management Institute, the Texas Tech University Petroleum Engineers and Memorial University’s Oil and Gas Development Partnership. Mr. Drummond received his Bachelor of Science in Mineral/Petroleum Engineering from the University of Alabama in 1983. Mr. Drummond was selected as a director because of his extensive industry and management expertise.

Erich L. Mosing. Mr. Mosing has been nominated by the Board to stand for election at this annual meeting. He served as a supervisory directorupon the recommendation of the Company from June 2020 until October 2021. Prior to that, he began his career with the Company full time in 2006 and has held various positions, including positions in marketing, until leaving the Company in 2015.ESG Committee. Further, Mr. Mosing received his Bachelor of Science Degree from the E. J. Ourso College of Business at Louisiana State University in 2006. Mr. Mosing was selected as a director nominee because of his extensive experience and familiarity with the Company’s business.

Alan Schrager. Mr. Schrager has been a non-executive member of the Company’s Board since October 2021. He currently serves on the board of directors of Associated Materials Incorporated, three Churchill Capital special purpose acquisitionfour other public companies and New Heights Youth, Inc.as permitted under our Corporate Governance Guidelines. The Board has determined that such simultaneous service does not impair his ability to effectively serve on the Company’s Board due to the other four companies being financial investment vehicles (such as SPACs), and previously served on the boardnot operating companies, with less time-consuming roles.

Name | Age | Position | ||||

Michael C. Kearney | 74 | Chairman of | ||||

Michael Jardon | 53 | President and Chief Executive Officer and executive director | ||||

Eitan Arbeter | 42 | Non-executive director | ||||

Robert W. Drummond | 62 | Non-executive director | ||||

Alan Schrager | 54 | Non-executive director | ||||

Lisa L. Troe | 61 | Non-executive director | ||||

Brian Truelove | 64 | Non-executive director | ||||

Frances M. Vallejo | 58 | Non-executive director nominee | ||||

Eileen G. Whelley | 69 | Non-executive director | ||||

Quinn Fanning | 59 | Chief Financial Officer | ||||

Alistair Geddes | 61 | Chief Operating Officer | ||||

Steven Russell | 55 | Chief Technology Officer | ||||

John McAlister | 57 | General Counsel and Secretary | ||||

6 | 2023 Proxy Statement |

|

MANAGEMENT

Michael C. Kearney | Chairman of the Board | |

Director since: 2013 Committee Membership: None | Mr. Kearney currently serves as the Company’s Chairman of the Board and non-executive director of the Board, a position he has held since October 2021. Previously, Mr. Kearney served as supervisory director from November 2013 until October 2021. He was Lead Supervisory Director from May 2014 until December 31, 2015, when he was named Chairman. From September 2017 until September 2021, he served as Chairman, President and Chief Executive Officer of the Company. In addition, he served on the Company’s Audit Committee from 2013 until 2017 and the Compensation Committee from 2014 until 2016. Mr. Kearney previously served as President and Chief Executive Officer of DeepFlex Inc., a privately held oil service company which was engaged in the manufacture of flexible composite pipe used in offshore oil and gas production, from September 2009 until June 2013, and had served as the Chief Financial Officer of DeepFlex Inc. from January 2008 until September 2009. Mr. Kearney served as Executive Vice President and Chief Financial Officer of Tesco Corporation from October 2004 to January 2007. From 1998 until 2004, Mr. Kearney served as the Chief Financial Officer and Vice President—Administration of Hydril Company. | |

Skills and Qualifications Mr. Kearney has over 25 years of upstream energy executive and board experience, principally in the oil services sector. In addition to his executive experience, Mr. Kearney’s oil service experience extends to serving on the Board of Core Laboratories from 2004 until 2017, most recently as its Lead Director, and serving on the board and Audit Committee of Fairmount Santrol from 2015 until its merger with Unimin Corporation in 2018. Mr. Kearney currently serves on the board of Ranger Energy Services, Inc., an independent provider of well service rigs and associated services, since 2018. He also serves as Chairman of its Audit Committee and as a member of its Compensation and Nominating and Governance Committees. Mr. Kearney received a Bachelor of Business Administration degree from Texas A&M University, as well as a Master of Science degree in Accountancy from the University of Houston. Mr. Kearney was selected as a director because of his experience in the oil and gas industry and his experience serving on the board of directors of other companies. | ||

Michael Jardon | President and Chief Executive Officer | |

Director since: 2021 Committee Membership: None | Mr. Jardon currently serves as the Company’s President and Chief Executive Officer and an executive member of the Company’s Board, positions he has held since October 2021. Prior to serving in his current positions, he was appointed Chief Executive Officer of Legacy Expro in April 2016, after five years as Legacy Expro’s Chief Operating Officer. Prior to joining Legacy Expro, he was Vice President Well Testing and Subsea responsible for North and South America at Schlumberger and held senior roles in wireline, completions, well testing and subsea from 1992 until 2008. He held a variety of assignments throughout North America, South America and the Middle East. He spent three years with Vallourec as President of North America, leading the commercial activities across North America, directing global research and development, as well as managing sales and strategy for the region. | |

Skills and Qualifications Mr. Jardon holds a Bachelor of Science degree in Mechanical Engineering and Mathematics from Colorado School of Mines. Mr. Jardon was selected as a director because of his extensive experience and familiarity with Legacy Expro and its affiliates as well as his industry and management expertise. | ||

| 2023 Proxy Statement | 7 |

MANAGEMENT

Eitan Arbeter | Non-Executive Director | |

Director since: 2021 Committee Membership: • Compensation | Mr. Arbeter has been a non-executive member of the Company’s Board since October 2021. Mr. Arbeter previously served on the Board of Directors of Legacy Expro. He shares portfolio management responsibilities as Portfolio Manager and Partner at Oak Hill Advisors, L.P., a leading alternative investment firm. Mr. Arbeter serves on the Oak Hill Advisor’s investment strategy | |

Skills and Qualifications Mr. Arbeter earned a B.B.A, with Honors, from the Stephen M. Ross School of Business at the University of Michigan. Mr. Arbeter was selected as a director because of his familiarity with Expro as well as his business acumen and capital markets expertise. | ||

Robert W. Drummond | Non-Executive Director | |

Director since: 2017 Committee Membership: • Compensation • ESG | Mr. Drummond has been a director of the Company since May 2017. Prior to October 2021, he served as a supervisory director of the Company, and thereafter, as a non-executive member of the Company’s Board. He currently serves as President and Chief Executive Officer of NexTier Energy Solutions Inc., f.k.a. Keane Group, Inc., an oilfield services company, a position he has held since August 2018. He also serves on the Board of Directors of NexTier since August 2018. Prior to serving in his current position, Mr. Drummond served as President and Chief Executive Officer of Key Energy Services, Inc., an oilfield services company, from March 2016 to May 2018, prior to which he was President and Chief Operating Officer since June 2015. He also served on the Board of Directors of Key Energy Services, Inc. from November 2015 until August 2018. Prior to joining Key, Mr. Drummond was previously employed for 31 years by Schlumberger Limited, where he served in multiple engineering, marketing, operations, and leadership positions throughout North America. His positions at Schlumberger included President of North America from January 2011 to June 2015; President of North America Offshore & Alaska from May 2010 to December 2010; Vice President and General Manager for the US Gulf of Mexico from May 2009 to May 2010; Vice President of Global Sales from July 2007 to April 2009; Vice President and General Manager for US Land from February 2004 to June 2007; Wireline Operations Manager from October 2003 to January 2004; Vice President and General Manager for Atlantic and Eastern Canada from July 2000 to September 2003; and Oilfield Services Sales Manager from January 1998 to June 2000. | |

Skills and Qualifications Mr. Drummond began his career in 1984 with Schlumberger. Mr. Drummond is a member of the Society of Petroleum Engineers and serves on the Advisory Board for the Energy Workforce & Technology Counsel and the University of Alabama College of Engineering Board. Formerly, he served as a member of the Board of Directors of the National Ocean Industries Association; the Board of Directors for the Greater Houston Partnership and on the Board of Trustees for the Hibernia Platform Employees Organization—Newfoundland; and as an advisory board member for each of the University of Houston Global Energy Management Institute, the Texas Tech University Petroleum Engineers and Memorial University’s Oil and Gas Development Partnership. Mr. Drummond received his Bachelor of Science in Mineral/Petroleum Engineering from the University of Alabama in 1983. Mr. Drummond was selected as a director because of his extensive industry and management expertise. | ||

8 | 2023 Proxy Statement |

|

MANAGEMENT

Alan Schrager | Non-Executive Director | |

Director since: 2021 Committee Membership: None | Mr. Schrager has been a non-executive member of the Company’s Board since October 2021. He currently serves on the board of directors of three Churchill Capital special purpose acquisition companies—Churchill Capital Corp V, Churchill Capital Corp VI and Churchill Capital Corp VII—and OHA Senior Private Lending Fund (U), LLC. He also serves on the board of T. Rowe Price OHA Select Private Credit Fund and New Heights Youth, Inc., and previously served on the board of Legacy Expro. He shares portfolio management responsibilities as Portfolio Manager and Senior Partner at Oak Hill Advisors, L.P., a leading alternative investment firm. Mr. Schrager serves on various Oak Hill Advisors committees, including the investment strategy, valuation, compliance and several fund investment committees. | |

Skills and Qualifications Previously, Mr. Schrager had senior research responsibility for investments in private credit companies, software, industrials and gaming. Prior to joining Oak Hill Advisors in early 2003, he was a Managing Director of USBancorp Libra, where he was responsible for originating, evaluating and structuring private equity, mezzanine and debt transactions and also held several positions at Primary Network, a data CLEC, including Chief Financial Officer and Interim Chief Executive Officer. Mr. Schrager previously worked in the Leveraged Finance and High Yield Capital Markets group at UBS Securities, LLC. Mr. Schrager earned an M.B.A. from the Wharton School of the University of Pennsylvania, and a B.A. from the University of Michigan. Mr. Schrager was selected as a director because of his familiarity with Expro as well as his business acumen and capital markets expertise. | ||

Lisa L. Troe | Non-Executive Director | |

Director since: 2021 Committee Membership: • Audit • ESG | Ms. Troe has been a non-executive member of the Company’s Board since October 2021. From January 2014 to June 2021, Ms. Troe was a Senior Managing Director of Athena Advisors LLC, a business advisory firm she co-founded to provide services in securities litigation, public company accounting, financial reporting and disclosure, compliance systems, enterprise risk management, and other business needs and strategies. From 2005 through 2013, Ms. Troe was a Senior Managing Director at FTI Consulting, Inc. (NYSE: FCN), a global business advisory firm. From 1995 through 2005, she served on the staff of the U.S. Securities and Exchange Commission’s Pacific regional office, including seven years as an Enforcement Branch Chief and six years as Regional Chief Enforcement Accountant. Prior to joining the SEC, she was an auditor at a Big Four public accounting firm and worked inhouse in upstream oil and gas companies and a petroleum products pipeline company. From 2003 to 2014, Ms. Troe was a member of the advisory board that functioned as a board of directors for a Texas general partnership engaged in oil and gas exploration and production. Ms. Troe serves on three other public company boards: HireRight Holdings Corporation (NYSE: HRT), a global provider of technology-driven workforce risk management and compliance solutions; Magnite, Inc. (Nasdaq: MGNI), an independent platform that facilitates the purchase and sale of digital advertising; and Stem, Inc. (NYSE: STEM), a provider of clean energy solutions and services designed to maximize the economic, environmental, and resiliency value of energy assets and portfolios. | |

Skills and Qualifications Ms. Troe is an experienced public company audit committee chair and CPA. Ms. Troe received her B.S. in Business Administration with honors from the University of Colorado. Ms. Troe was selected as a director due to her expertise in public company accounting, financial reporting and corporate governance, as well as her public company director and audit committee experience. | ||

| 2023 Proxy Statement | 9 |

MANAGEMENT

Brian Truelove | Non-Executive Director | |

Director since: 2021 Committee Membership: • Audit • ESG | Mr. Truelove has been a non-executive member of the Company’s Board since October 2021. He has over 40 years of experience in the global upstream oil and gas industry. From 2018 to October 2021, he served on the Board of Directors of Legacy Expro. Mr. Truelove has also served on the Board of Directors of Bristow Group Inc. since 2019. From 2011 to 2018, he worked for the Hess Corporation, an energy company, most recently as Senior Vice President, Global Services, which included serving as the Chief Information Officer, Chief Technology Officer, and leading the Supply Chain/Logistics organization. Prior to assuming this role, he served as Senior Vice President for Hess’ global offshore businesses and prior to that he was Senior Vice President for Global Drilling and Completions. From 1980 through 2010, Mr. Truelove worked for Royal Dutch Shell where he most recently served as Senior Vice President for the Abu Dhabi National Oil Company/NDC on secondment from Shell. Prior to that he led Shell’s global deepwater drilling and completions business. | |

Skills and Qualifications During his time with Hess and Shell, Mr. Truelove held leadership positions around the world in drilling and production operations and engineering, asset management, project management, R&D, Health/Safety/Environment, and corporate strategy, amongst others. Mr. Truelove was selected as a director because of his extensive experience in the oil and gas industry and his public company experience. | ||

Frances M. Vallejo | Non-Excutive Director Nominee | |

Committee Membership: None | Ms. Vallejo has been nominated by the Board to stand for election at this annual meeting. She is a former executive officer of ConocoPhillips, an independent exploration and production company, where she began her career in 1987. She served as Vice President, Corporate Planning and Development from April 2015 until December 2016 and as Vice President and Treasurer from October 2008 until March 2015. Prior to October 2008, she served as General Manager Corporate Planning and Budgets, Vice President Upstream Planning and Portfolio Management, Assistant Treasurer, Manager Strategic Transactions, and in other geophysical, commercial, and finance roles. Ms. Vallejo currently serves on the board of directors of Coterra Energy Inc, a publicly traded exploration and production company with focused operations in the Permian Basin, Marcellus Shale and Anadarko Basin, since October 2021 and Crestwood Equity Partners LP, a publicly traded master limited partnership that owns and operates oil and gas midstream assets located primarily in the Bakken Shale, Delaware Basin and Powder River Basin, since February 2021. | |

Skills and Qualifications Ms. Vallejo was a member of the Board of Trustees of Colorado School of Mines from 2010 until 2016 and is a member of the Colorado School of Mines Foundation Board of Governors. Ms. Vallejo holds a Bachelor of Science in mineral engineering mathematics from Colorado School of Mines and a Master of Business Administration from Rice University, where she was named a Jones Scholar. Ms. Vallejo was selected as a director nominee because of her vast experience in the oil and gas industry and extensive leadership roles in corporate planning, budgeting, and treasury. | ||

10 | 2023 Proxy Statement |

|